L&T Emerging Businesses Fund Direct YouTube

The merger between L&T Mutual fund and HSBC Mutual fund took place on 26 th November, 2022. Which AMC has been acquired? L&T Mutual fund has been acquired by HSBC Mutual fund and all the L&T funds have been migrated to HSBC. What happens to my existing L&T and HSBC investments?

L&T Emerging Businesses Fund Direct Growth Best Small Cap funds 2022 Should you invest now

₹69.8977 0.75% As on 05-Jan-2024 Overview Return Premium Coverage Risk Portfolio Fund News Other Investment Strategy The Scheme will primarily be a diversified equity fund which will invest predominantly in small cap stocks to generate long term capital appreciation. Returns Calculate SIP Returns of HSBC Small Cap Fund Upfront Investment ₹

L&T Emerging Businesses Fund 2022 L&T Mutual Funds Small Cap Funds YouTube

(i) a change in the sponsorship, trusteeship, management and administration of the schemes of L&T Mutual Fund ("L&T MF Schemes") whereby HSCI will become the sponsor of the L&T MF Schemes, HSBC Trustees will become the trustee of the L&T MF Schemes and HSBC AMC will have the rights to manage, operate and administer the L&T MF Schemes, which will.

NFO Review L&T Emerging Opportunities Fund Series I NFO 2018 Groww

Previously called: L&T Emerging Businesses Direct-G Invest Now Invest Now Add to watchlist Add to compare Track in portfolio NAV as of Jan 09, 2024 ₹ 76.064 0.05 % 1-D Change Returns since inception 23.34% p.a. Direct - Growth You get upto 1.02% extra returns Share ET Money Rank 12 Out of 17 Consistency of returns 3.5 Average

L&T Emerging Businesses Fund Review Groww

Category: Equity Type: Smallcap AUM (As on 31 Oct, 2021): Rs 7,554 cr Benchmark: S&P BSE Small Cap Total Return Index What it costs NAV (As on 23 Nov, 2021) Growth option: Rs 44.27 IDCW: Rs 30.60 Minimum Investment: Rs 5,000 Minimum SIP amount: Rs 500 Expense ratio (As on 31 Oct, 2021) (%): 1.88

L&T Emerging Businesses mutual fund review Showing uptick in performance The Economic Times

L&T Emerging Businesses Fund - Regular Plan - Growth-129223 L&T Emerging Businesses Fund - Regular Plan - IDCW-129221 30: SEBI Codes. Investment Amount Details. 31. Minimum Application Amount: 5,000 32 Minimum Application Amount in multiples of Rs. 1 33 Minimum Additional Amount: 1,000

L&T Emerging Businesses Fund YouTube

Investment Objective : To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. Emerging companies are businesses which are typically in the.

L&T Emerging Businesses Fund Review Groww

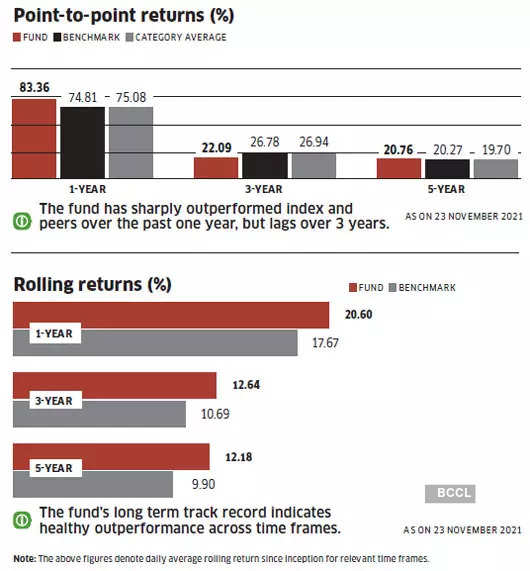

This is a performance review of L&T Emerging Businesses Fund a small cap fund. We compare how it has fared against its benchmark and peers. Launched in May 2014, this will invest in "Emerging companies" defined as an early stage business that has the potential to grow at a faster rate than established companies.

L&T बेस्ट फंड स्कीम निवेश मात्र 50000/ पाएं ₹72,10,506 L&T Emerging Businesses Fund Direct

With the boom in mid and small cap segment, L&T Emerging Businesses Fund has caught the fancy of mutual fund investors. This can be clearly noticed from the multifold rise in its Assets Under Management (AUM). In the past 1 year, the fund's corpus has grown almost 10x from just about Rs 380 crore in December 2016 to around Rs 3,587 crore as.

L&T Emerging Business Fund by CA Ravinder Vats YouTube

L&T EMERGING BUSINESSES FUND GROWTH 69.9 0.0 as on 05-Jan-2024 EQUITY | SMALL CAP 103.92 1 YEAR RETURNS 2.94 3 YEAR RETURNS 16.73 5 YEAR RETURNS 3 / 5 FundFinder Rating Buy 5000.0 Minimum Investment 500.0 Minimum SIP Investment 1000.0 Additional Purchase Option Type Three Year NAV

L&T Emerging Businesses Fund Review by Gulaq Medium

46.77900. NAV Diff is +0.216 from Previous Day. 0.46% Up. 11-10-2022 (Tue) 46.56300. No Difference. -. L&T Emerging Businesses Fund - Regular Plan - Growth NAV History, L&T Emerging Businesses Fund - Regular Plan - Growth NAV Value, Graph Chart History, NAV Percentage Up & Down Chart History.

L&T Emerging Businesses Fund G Business funding, Investing money, Fund

A huge wave of liquefied natural gas is about to flood a world that's supposed to be transitioning away from fossil fuels. More than $235 billion has been plowed into the next slate of projects.

Mutual Fund Review L&T Emerging Businesses Fund 2019 Top Small Cap Mutual Funds YouTube

Key Benefits. Invests in companies that are in the early stage of development and have the potential to grow their revenue and profits at a higher rate as compared to the broader market. Follows bottom-up stock selection using our proprietary G.E.M investment approach. At least 65% exposure to stocks beyond the top 250, in terms of market.

L&T Emerging Businesses Fund Detailed Review www.mfyadnya.in YouTube

L&T Emerging Businesses Fund (G) - Explore L&T Emerging Businesses Fund (G) for updates on latest NAV, Performance, Dividends, Return Details, Portfolio Holdings, AUM Movement, etc. Visit Karvy Online to get information on mutual fund news and updates!

l&t emerging businesses fund review l&t emerging businesses fund direct growth review YouTube

L&T Emerging Businesses Fund - Analyse AUM, NAV, Returns and more L&T Emerging Businesses Fund is an Open-ended, small-cap category fund. The risk in this fund is below average but the returns are high LIC IPO Best Demat Account Gold Rate Prediction Share Market Courses Best Trading App Markets Live Share Market Live Nifty 50 Live Sensex

L&T mutual fund 5 best L&T mutual fund Return upto 30 best LnT SIP Emerging business fund L

L&T Emerging Businesses Growth Direct Plan NAV ₹76.4592 +0.75% (5 Jan) AUM 12,795 Cr TER 0.69% Risk Very High Risk Rating Insights Top searched fund this month Net Asset Value (NAV) is above its 200 days moving average Asset Under Management (AUM) is in the top 25% of comparable funds In beta. Send feedback here. Compare with other fund